Both income planning and retirement income planning have become increasingly important to investors. With an aging population, we will see the latter take center stage in many discussions of wealth management. A key element of retirement income planning is understanding the importance of how various types of incomes are taxed, such that measures may be taken to reduce taxes payable wherever possible.

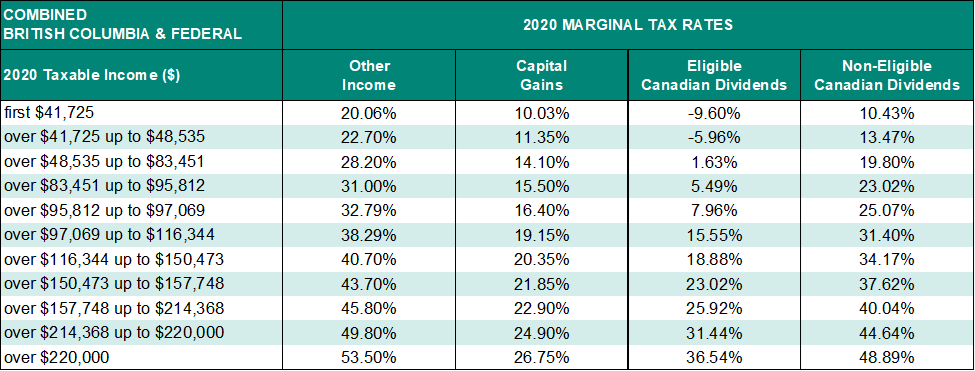

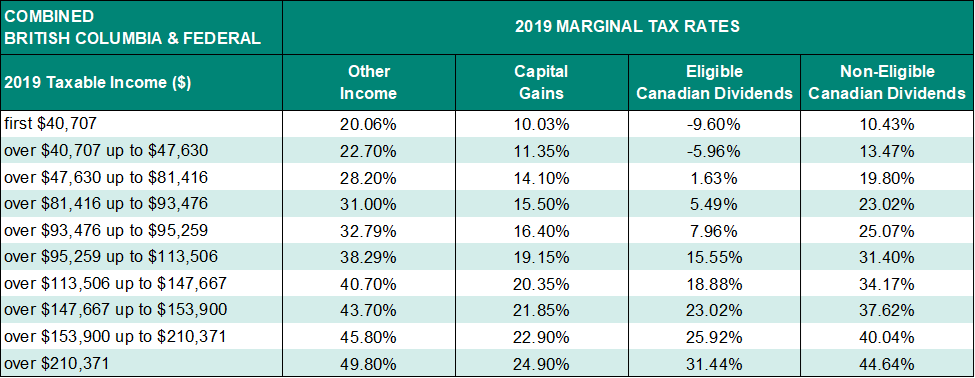

As per the tax rate tables below, notice that in general, employment income and interest income (labelled as “other income”) are taxed at the highest rate, similar to income from withdrawals from RRSP and RRIF registered funds. Capital gains and eligible/non-eligible dividends are typically taxed at a much lower rate.

For those who are subject to the Old Age Security (OAS) claw back, each dollar that exceeds about $75,000 in income will effectively be taxed at an additional 15%.

2020 PERSONAL TAX RATE [1] [2]

2019 PERSONAL TAX RATE [1] [2]

[1] https://www2.gov.bc.ca/gov/content/taxes/income-taxes/personal/tax-rates

[2] https://www.canada.ca/en/financial-consumer-agency/services/financial-toolkit/taxes/taxes-2/5.html

The Bottom Line

Retirement planning, if done well, can enable investors to accumulate assets in a tax efficient manner, in order to provide tax-optimized retirement income withdrawals. In order to accomplish this, the retirement planning process should begin many years before retirement, such that the appropriate investment vehicles are utilized.

Please feel very welcome to contact us to learn more about how best to optimize your retirement income, such that you are receiving the most benefit from your hard-earned savings and investments.